Minter Hub is a Minter sidechain bridging Minter, Ethereum, and Binance Smart Chain (BSC) blockchains. In the future, we plan to interconnect with Polkadot, Cardano, Solana, and other popular networks as well.

Executing user commands, Minter Hub acts as a custodian and operator of tokens on the blockchains mentioned above. For example, using the bridge, one can send the USDT token from Ethereum to Minter network or BNB from Ethereum to Binance Smart Chain. There’ll be a total of 6 directions at the beginning. They’ll be opening gradually, starting with token transfers from Minter to Ethereum.

Built on top of Cosmos SDK, Minter Hub is spearheaded by Minter’s lead developer Daniil Lashin. While working on the project, we had suggested several critical improvements that were accepted and rewarded by the Cosmos team.

Minter Hub will have 16 oracles (validators of the network) and run on the PoS consensus, which means using stake as collateral in order to vote on blocks. There will be no delegators in Minter Hub. If necessary, however, the decision on changing the rules and code can be made by blockchain’s oracles.

Cross-chain transfers are the new era of sovereign blockchains. They ensure not only the communication between the networks, but also reliable, fast, and secure decentralized transactions. No one can cancel, alter, or censor such transfers.

HUB Token

HUB is the Minter Hub network’s native token, whose supply is 1,000,000 units. At the time of writing, HUB represents an ERC-20 token on the Ethereum network with no lock-up periods or any other limitations, meaning the token is completely free to circulate.

It is impossible to increase the number of tokens (exceed the maximum supply) as it was fixed on the blockchain. Burns and lock-ups are decided upon through votes among Minter Hub blockchain’s oracles.

Current HUB distribution:

- Fund: 950,000 tokens

- Minter community: 50,000 tokens

In the future, tokens on the fund’s part can be sold to investors or customers, accrued as rewards, or credited as payment for services. Below is the list of prospective blockchain participants and HUB token holders as we see it:

- Team

- Investors (with smart contract-based vesting of 3–5 years)

- Oracles

- Members of the community

- Partners (marketing, legal, exchange)

- Market makers

In addition to the 50,000 tokens already in circulation, an additional 50,000 tokens (max.) may be issued in 2021. The fund and the team will jointly develop a specific supply distribution roadmap in the beginning of 2022 once the bridge’s main launch stages have been completed and blockchains, integrated. It’s already become standard practice for DeFi projects — e.g., Uniswap and 1inch — to distribute initial supply to the community and customers for free and subsequent issuance, to the team, investors, partners, and other useful participants.

Role of Community

Since the very beginning, we’ve aimed to design the most balanced token distribution scheme for the members of our community. That’s why the first 50,000 HUBs have been accrued to the addresses of 2,000 most active Minter participants. Those who have been helping the project in one way or another since 2017, when we were just starting.

The initial distribution went to 5 categories of users:

- Minter network validators

- Major Minter network delegators: 1,000 participants

- Minor Minter network delegators: 1,000 participants picked randomly

- All-time contributors

- Q3 2020 contributors

Participants could apply on their own or get tokens automatically in multiple categories at once, so their balances have been summed up.

HUB tokens were issued on the Ethereum blockchain October 27, 2020, and distributed among all members of the community who expressed their willingness to participate or were eligible to receive automatically.

Governance

As it’s been mentioned above, 1 million HUBs will be issued in total, of which 50,000 have been already distributed among the community members and 50,000 may enter into circulation during 2021.

First of all, HUB will be used as a governance token, with the help of which the main decisions on the development of the Minter Hub network will be made. After Minter upgrades, Minter Hub oracles will also start managing DAO (Decentralized Autonomous Organization) funds, which make up 10% of all fees and rewards on Minter mainnet.

We believe that fair distribution of HUB has made it possible to give tokens to those who can make the most significant contribution to the development of the two networks. Therefore, voting on the most important issues completely falls into the hands of HUB holders.

This year, we’ll develop and roll out a mechanism that will allow any member of the community to submit their proposal, followed by a vote among all interested parties. Such proposals may include changes to the code and rules of Minter and Minter Hub, as well as allocations of the DAO budget. The very procedures for submitting proposals and voting will be as simple as possible and require minimal effort from the participants. We want to completely remove the bureaucratic and technological barriers that are observed in other blockchains, where, instead of real democracy, governing often turns into political games or just fiction. A detailed proposal on the management of the networks will be outlined in a separate document.

Tokenomics

In 2021, we see three main use cases for HUB tokens to create a growing blockchain economy and long-term balance of power:

- Staking

- Fee discounts

- Tips

Staking

Minter Hub oracles need to stake HUBs for transactions to be processed fairly and blocks to be formed. For that, they receive up to 1% of the fees charged for all transfers between the Minter, Ethereum, and Binance Smart Chain networks. The fee is collected for depositing the money. For example, when someone transfers 100 USDT from Minter network to Ethereum, 1 USDT is paid out to oracles proportionally to their stake in Minter Hub.

Regardless of the transfer direction — and in the case of 3 networks (Minter, Ethereum, Binance Smart Chain), there are 6 of them — all oracles’ fees are accrued on Minter blockchain.

In basic scenario, oracles get 100% of fees collected, which translates to up to 1% on all transfers, but users can have discounts if they have free HUB tokens on their balance.

Let’s take a detailed look at the economy of oracles’ participation in Minter Hub under the following parameters:

- Price for 1 HUB: $100

- No. of staking HUBs: 20,000 tokens

- Daily transfer volume: $1M

- Transfer fee: 1%

- No. of oracles: 16

Assuming that Minter Hub processes $1,000,000 worth of transfers daily at the fee of 1%, all oracles get $10,000. Assuming the HUB token’s price is $100 and the total volume staked is 20,000 HUB, we have an equivalent of $2,000,000. The oracles’ returns amount to 0.5% per day or 182.5% per year. Since such profitability exceeds the dollar one on the market by a wide margin, it’s safe to say we might expect a serious growth in demand for the token, which, in its turn, might result into the price rising to $1,000. Let’s re-calculate the returns with these numbers: $10,000 in daily fees, $1,000,000 in transfers, and $20,000,000 in stakes give an 18.25% APY, which corresponds to the DeFi returns in dollars and outweighs the figures of the traditional market by almost 10 times.

In basic scenario, we only consider 20,000 stakeable tokens because we understand the current distribution of HUB and the mood of the participants. Until the end of 2021, the total stake is unlikely to exceed 30,000 tokens or drop below 10,000 HUB. Therefore, without going into detailed calculations, we can give rough outlooks:

- Pessimistic: if the volume of transfers between the networks is $100,000 and the price of HUB token is $100, the profitability of oracles will be 15–40%, depending on the number of staked tokens

- Optimistic: an increase in the volume of transfers to $10 million per day would give oracles an income of $36.5 million per year, for which participants will be ready to provide a collateral of $200–500 million in stake, which, given the limited supply of HUB tokens on the market, might translate into a price of $500–5,000 apiece

Taking into account the unique properties of the Minter Hub network together with the capabilities of Minter, and specifically AMMOB (on-chain automated market maker with order book), we see the following use cases:

- Transfer of tokens with swapping. For example, a user needs to transfer USDT from Binance Smart Chain to Ethereum with conversion into USDC. The route will look like this: USDT is sent to Minter, where it is exchanged for USDC through liquidity pools and then withdrawn to the Ethereum network. This is the simplest, fastest, and completely decentralized option, which guarantees that transaction of any volume will be executed. The fee for all transactions will be 1% for deposit into Minter, 0.2% for swap, and 1% for withdrawal into Ethereum, plus gas costs. Today, this solution is incomparable in terms of seamless execution, providing the user with complete safety and control over their funds at each of the steps.

- Sending almost any cryptocurrency to any user of the three blockchains. This is noteworthy because if you have a given token on the Minter address and native ETH and BNB on Ethereum and Binance Smart Chain, respectively, you can easily make a transaction to another network. For example, if the transfer comes from Minter, then tokens are swapped for the ones that the recipient needs instantly before withdrawal and then credited to the specified address through Minter Hub. At the same time, in Minter, this is done by simply entering the recipient’s address, ticker of the token, and amount to be credited, after which all conversions and crediting itself take place. Transaction costs will be 0.2% for conversion and 1% for transfer to another network.

- On-demand liquidity. This is perhaps the coolest feature possible: active blockchain users often need to get some volume of tokens fast and at a specific price. With Minter, it’s implemented like this: the exchange costs are compared across three networks at once (Minter, Ethereum, Binance Smart Chain) and all liquidity pools. The most cost-efficient one is determined, including the costs of transfers and gas, and the process starts. For example, it turns out that the most optimal way to buy BNB for USDC is through PancakeSwap on the Binance Smart Chain: USDC is withdrawn to the Binance network for 1%, the swap is made in the pool, and BNB is returned back to Minter. At the same time, the Binance network fees can be paid directly from Minter.

The examples above clearly show how much need there can be for swaps and transfers made through Minter Hub. And for each action, oracles get 1%.

Discounts

Bearing in mind that the 1-percent cross-chain transfer fee could be high for professional players who trade in big volumes, while realizing that oracles need to be interested in maintaining the Minter Hub network in the long run, we are going to introduce the following discount system for HUB holders.

The HUB token will reduce fees for cross-chain transfers between Minter, Ethereum, and Binance Smart Chain. Since all three addresses are managed by one seed phrase, it was proposed to lower the fees for those who hold HUB on any of them. By default, the fee is 1% for any transfer between the networks, but the availability of tokens (regular HODLing) will now give the following discounts:

1 HUB -10%

2 HUB -20%

4 HUB -30%

8 HUB -40%

16 HUB -50%

32 HUB -60%

For example, if you have 16 HUBs on your balance, then when transferring USDT from the Minter network to Ethereum, the fee you’ll pay will be not 1% but 50% less — that is, 0.5%.

The discounts are especially beneficial for liquidity providers who will be making frequent and voluminous conversion transfers. For example, at the maximum discount, transfer of ETH from the Ethereum network to BNB on the Binance Smart Chain will cost only 1%:

– Deposit of ETH into Minter: 0.4%

– Exchange of ETH for BNB on Minter: 0.2%

– Withdrawal to Binance Smart Chain: 0.4%

Total: 1% for the fastest and most reliable decentralized swap from one blockchain to the other. That’s one-of-a-kind.

Such an economic policy encourages users to keep HUB on addresses for as long as possible, buying tokens in advance and not selling them because with a finite supply of only 1,000,000, there may no longer be a second chance to generate a discount. If at the beginning of March, at a price of $3 per HUB, the maximum discount of 60% could be staked for only $96, then three weeks later, it’s already more than $2,500.

By reducing the oracles’ income from fees, we give a strong stimulus for the demand for HUB tokens, which means an increase in the capitalization of the validator stakes. This makes blockchain validation more competitive, incentivizing oracles to perform their duties at their best.

Tips

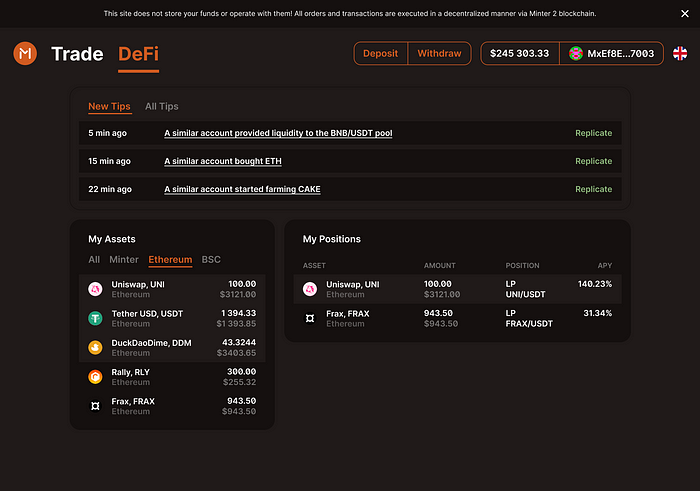

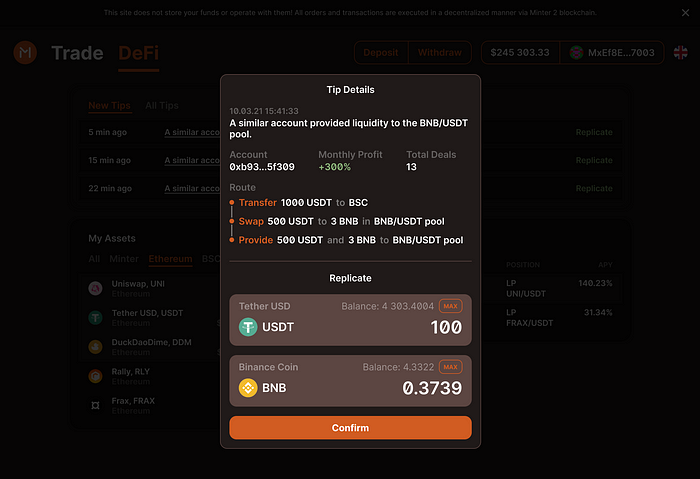

The most important element of tokenomics will be tips about trades and profitable operations carried out using Minter Hub. Any community member will receive tips if they have at least 1 HUB on their address on any of the networks. That way, we’ll help answer the main question of the DeFi market: “How to make money?”

A distinctive feature of decentralized finance in general is the ability of users to monitor the actions of various addresses and copy successful transactions. Until now, the so-called “social trading” was only available in closed apps or clubs and mainly in the field of trading. We plan to offer tips across the entire spectrum of financial services — from trading and liquidity management to loans and deposits. And the most important thing here is that you can participate in promising transactions on three networks simultaneously, operating with funds from a single app, making fast transfers and swaps to the tokens you need via Minter Hub.

One of the interfaces reflecting this approach will be presented in the Minter Hub product, allowing you to see potentially hot deal options by simply tapping any of your current tokens on any of the networks. HUB holders will receive automatic tips as soon as one of the top traders or financiers makes a potentially profitable transaction in a top token or leading project or protocol.

Imagine that now the system itself will tell you, based on the analysis of millions of addresses and machine learning, what to do with your capital. Users will be able to repeat transactions, receiving complete data on how successful the trader they are copying was over the last week, month, and quarter, what their portfolio is, and what activities they prefer.

Since Minter Hub gives quick access to mirrored assets across three networks at once, instead of monitoring, say, USDT on the Ethereum network only, our system will still monitor USDT on Minter and Binance Smart Chain as well.

From the very start, 2,000 members of the Minter community will be able to use these tips, and eventually, everyone who buys the HUB token and simply keeps it on either of the three addresses.

All three areas of use of the HUB token — staking, discounts, and tips — create sufficient demand for a token that’s overly limited in supply. This will lay the foundation for the growth of blockchain capitalization, and hence the well-being of members of the Minter community.

Pricing

At this point, the team does not have a goal to participate in the formation of the HUB token pricing in any way. The team will not be engaged in listing the HUB token or acting as a market maker or hiring one. We believe that should be up to the free market and we should only step in to set the right economic conditions for all Minter Hub participants and token holders.

This approach immediately found a market solution: in the very first days, community members launched trading in the HUB-USDT pair on Uniswap, setting the starting price at $0.10. The first trade took place October 27, 2020, when 9 HUBs were bought for $1.

Today (March 26, 2021), the price of HUB is almost $80 and the liquidity of the Uniswap pool, $875,000.

When Minter upgrades to version 2, we expect the arrival of numerous pools with the HUB token, which will provide the market with full-fledged access to liquidity, and providers, with the ability to profit from trading.

Overall, we see a lot of interest in HUB being listed on centralized and decentralized venues. This is mainly because the token is represented in both ERC-20 and BEP-20 (coming soon) standards, which facilitates the listing process greatly, making it less time-consuming and expensive.

The team does not exclude that it will support listings and integrations in one form or another, including rewards in HUB tokens. But it will not initiate such activities, giving the community complete freedom of action.

Investors

Since the first announcements of Minter Hub, the fund (token holder) has been receiving offers from investors interested in long-term participation in the protocol. We are talking about both venture funds and those focused exclusively on blockchain projects.

At the moment, the fund has no interest in selling tokens, because the blockchain has not been launched yet and is not integrated with the main networks, a distribution policy has not been made, and business models have not been determined.

When we are ready for investors to join, we plan to sell only small portions of tokens, no more than 5% per fund, and always with a lock-up or vesting period of 3–7 years. The longer the period, the higher the discount at the time of purchase.

Speaking of investors, we mean only qualified legal entities that comply with all laws and regulations in the field of cryptocurrencies in their respective jurisdictions.

Technologies

Minter Hub is based on Cosmos SDK and a modified Peggy solution that’s developed by the Cosmos team.

The project’s code can be accessed in a public repository: https://github.com/MinterTeam/minter-hub.

Minter Hub is supported by validators, here’s what they launch on their servers:

– Minter node

– Ethereum node

– Minter Hub node

– Ethereum Orchestrator, software that monitors the events on the Ethereum network and broadcasts them onto Minter Hub. It’s also responsible for sending withdrawal transactions to Ethereum.

– Minter Orchestrator, software that monitors the events on the Minter network and broadcasts them onto Minter Hub. It’s also responsible for sending withdrawal transactions to Minter.

Mirrored coins are locked on the MultiSig accounts of Minter Hub validators up until they are requested to be withdrawn.